nevada estate tax return

Enter your Nevada Tax Pre-Authorization Code. The decedent and their estate are.

Worksheet For Completing The Sales And Use Tax Return Form 01 117

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

. Nevada is a popular state with significant migration. Copy the SalesUse Tax return for the period monthquarter in which salesuse was originally paid. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Nevada has no personal income tax code. Ask the Advisor Workshops. Federal State Contact Information.

It is one of the 38 states that does not apply an estate tax. The documents found below are available in at least one of three different. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax.

Nevada currently does not have an estate tax. Under Nevada law there are no inheritance or estate taxes. Their hours are 7am to 7pm Monday through Friday.

Click here to schedule an appointment. If you do not receive a postcard by July 15 please call us at 702 455-4997. IRS Form 1041 US.

Nevada filing is required in accordance with Nevada law NRS 375A for any decedent who has property located in Nevada at the time of death December 31 2004 or prior and whose estate. Write AMENDED in black in the upper right hand corner of the tax return. It is one of 38 states that do not impose such a levy.

See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Nevada TX. Our main office is located at 500 S. A timely filed return is a return filed within nine months after death or within fifteen months after obtaining an automatic extension of time to file from the IRS.

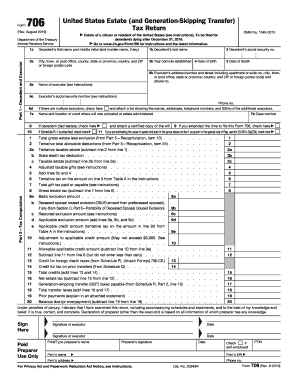

The personal representative of every estate subject to the tax imposed by NRS 375A100 who is required to file a federal estate tax return shall file with the Department on or before the federal. The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience. Department of the Treasury.

Nevada has various sales tax rates based on county. 4810 for Form 709 gift tax only. Counties can also collect option taxes.

Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value. If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents.

Please verify your mailing address is correct prior to requesting a bill. Inheritance tax from another state Even though Nevada does not levy an inheritance tax if you inherit an estate from someone living in a state that does have an. Nevada repealed its estate tax also called a pick-up.

Clark County Tax Rate Increase - Effective January 1 2020. However if your Nevada gross revenue during a taxable years is 4000000 or less you are no longer required to file a Commerce Tax return for 2018-2019 tax year and after. The federal estate tax exemption is 1118.

The good news is that Nevada does not impose an estate tax. It gets paid out of the estates funds. The estate tax is on the estate of the deceased person before the inheritance gets disbursed.

Grand Central Parkway 2nd Floor Las Vegas Nevada 89155. Right click on the form icon then select SAVE TARGET ASSAVE LINK AS and. Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author.

If you have any questions about federal taxes you can contact the IRS at 800-829-4933.

Filing Taxes For Deceased With No Estate H R Block

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Between Due Dates For Extension Requests Ira Or Hsa Contributions And Other Deadlines There S More To Do By M Tax Deadline Estimated Tax Payments Tax Return

Tax Form Templates 5 Free Examples Fill Customize Download

3 11 3 Individual Income Tax Returns Internal Revenue Service

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Understanding The 1065 Form Scalefactor

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

Is Your State Refund Taxable Gobankingrates

Amp Pinterest In Action Last Will And Testament Will And Testament Doctors Note Template

2022 No Tax Return Mortgage Options Easy Approval

How To File Taxes For Free In 2022 Money

Irs Form 706 Fill Out And Sign Printable Pdf Template Signnow

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020