nc sales tax on non food items

County and local taxes in most areas. Friday June 10 2022.

N C Dept Of Revenue On Twitter Alleghany County S Combined State And Local Sales Tax Rate Will Be Raised To 7 Effective October 1 2022 The New Rate Will Apply To The Sales

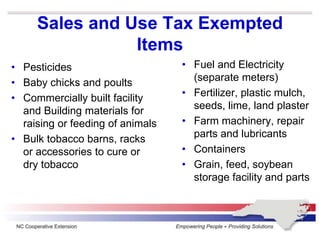

This page discusses various sales tax exemptions in North.

. Sales and Use Tax Sales and Use Tax. With the exception of some. Arizona grocery items are tax exempt.

The Article 43 half-cent Transit. Depending on local municipalities the total tax rate can be as high as 75. Laundries Apparel and Linen Rental Businesses and Other Similar Businesses.

Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any. Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7.

A customer buys a toothbrush a bag of candy and a loaf of bread. Is Food Taxable In North Carolina Taxjar. Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price.

Arizona grocery items are tax exempt. Sales Tax Rates In Major Cities Tax Data Tax Foundation. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 275 percent.

It is not intended to cover all provisions of the law or every taxpayers. North Carolinas general state sales tax rate is 475 percent. Nc sales tax on non food items.

Certain items have a 7-percent combined general rate and some items have a miscellaneous. The information included on this website is to be used only as a guide. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. The North Carolina NC state sales tax rate is currently 475. Gross receipts derived from sales of food non-qualifying food and prepaid meal plans and the applicable sales and use tax thereon are to be reported to the Department.

A bundled transaction that includes a prepaid meal plan is taxable in accordance with NC. Prescription Drugs are exempt from the North Carolina sales tax. While the North Carolina sales tax of 475 applies to most transactions there are certain items that may be exempt from taxation.

The North Carolina state sales tax rate is 475. With the exception of some. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7.

Some examples of items that exempt from North.

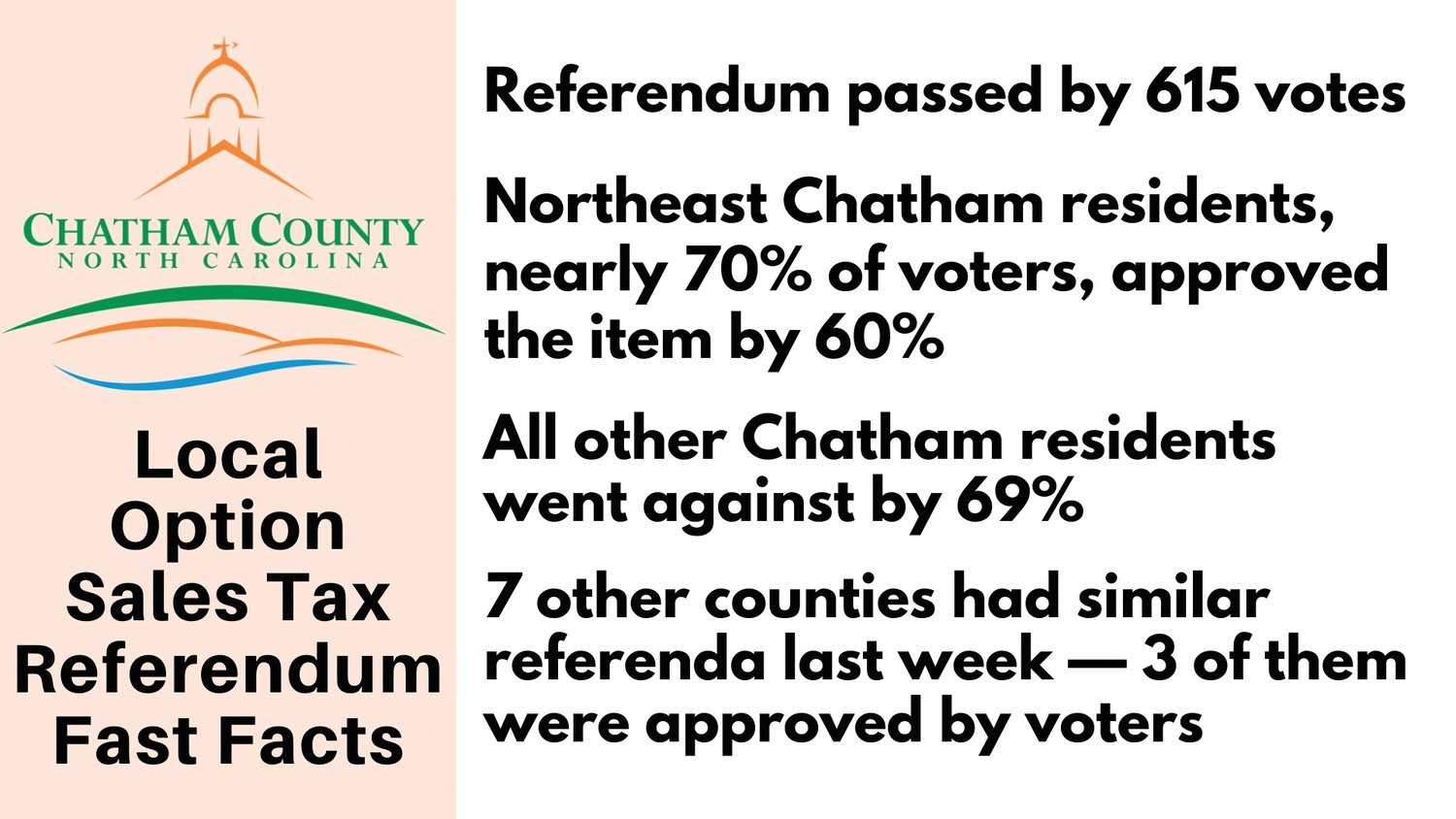

Chatham S Sales Tax Option Was Approved So What S Next The Chatham News Record

North Carolina Sales Tax Sales Tax North Carolina Nc Sales Tax Rate

North Carolina Sales Tax Rate Rates Calculator Avalara

North Carolina Sales Tax Update

Sales Taxes In The United States Wikipedia

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Is Food Taxable In North Carolina Taxjar

How To Register File Taxes Online In North Carolina

North Carolina Sales Tax Small Business Guide Truic

Easley Michael Press Release 2008 07 25 Gov Easley Announces More Savings Offered At N C Sales Tax Holiday Consumers Can Save Even More This Year On Back To School Needs Clothing And Computers Governors Papers

New Jersey Sales Tax On Restaurants Sales Tax Helper

State And Local Sales Tax Rates Midyear 2022

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Sales And Use Tax Rates Effective October 1 2020 Ncdor

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

Is Food Taxed In North Carolina Open The States

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation